- Home

- /

- High Courts

- /

- High Court of J & K and Ladakh

- /

- Insurance Company Not Liable To...

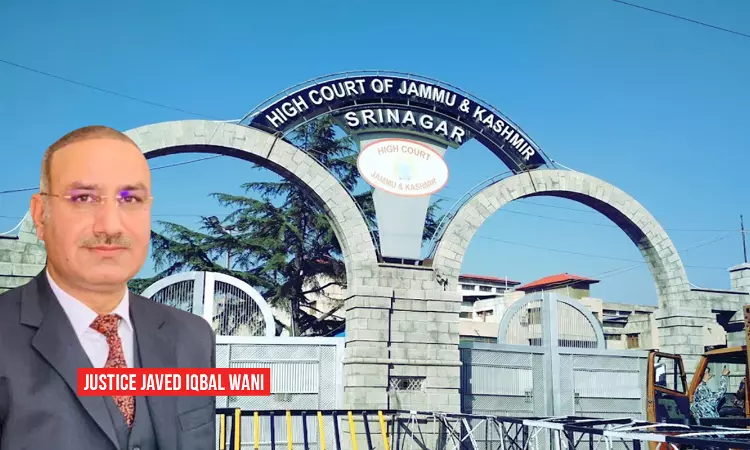

Insurance Company Not Liable To Indemnify If Vehicle Owner Fails To Discharge Initial Onus Regarding Validity Of Driver's License: J&K High Court

LIVELAW NEWS NETWORK

2 May 2024 6:11 AM GMT

The Jammu and Kashmir and Ladakh High Court has ruled that an insurance company cannot be held liable to compensate an insured unless the vehicle owner discharges the initial burden of proving the driver's license validity.In dismissing a review petition and upholding its order of exonerating the insurance company from its liability to indemnify Justice Javed Iqbal Wani observed,“In view of...

The Jammu and Kashmir and Ladakh High Court has ruled that an insurance company cannot be held liable to compensate an insured unless the vehicle owner discharges the initial burden of proving the driver's license validity.

In dismissing a review petition and upholding its order of exonerating the insurance company from its liability to indemnify Justice Javed Iqbal Wani observed,

“In view of the failure of the owners to discharge their initial onus the insurance company could not have been saddled with the liability to indemnify the insured, more so, when the insurance company had proved with clinching and credible evidence that the driving license possessed by the driver was fake/invalid”.

The case originated from an incident where Tariq Ahmad Mir, a 22-year-old, lost his life in a vehicular accident while riding a motorcycle. Following this event, the legal heirs of Tariq Ahmad Mir filed a claim petition under the Motor Vehicles Act, 1988, before the Motor Accident Claims Tribunal (MACT), Anantnag.

The claimants, seeking compensation, named both the owner/s and the driver of the offending vehicle, along with the insurance company, United India Insurance, as respondents. Notably, the Tribunal framed several issues, with one crucial question revolving around the validity of the driver's license at the time of the accident.

During the proceedings, the insurance company presented compelling evidence, including testimony from witnesses and documentation. However, the owners of the offending vehicle failed to meet their initial burden regarding the driver's license's validity. Consequently, the Tribunal awarded compensation to the claimants, holding the insurance company liable to pay.

However, the insurance company appealed this decision before the High Court, arguing that without the owners discharging their initial onus regarding the driver's license validity, they couldn't be held responsible. The High Court, concurred with the insurer's argument and set aside the award as a consequence of which a review petition came to be filed.

Upon In a meticulous review of the case, Justice Wani emphasized the criticality of the owner's responsibility in establishing the driver's license's legitimacy. The Court underscored that without such proof, insurance companies cannot be saddled with the liability to indemnify the insured.

While noting that neither the first owner (who appeared before MACT) nor the second owner (who did not appear) presented any evidence regarding the driver's license validity the bench relied on the Apex Court judgment in "Pappu and others vs. Vinod Kumar Lamba and another" (2018 ACJ 690), and held that the onus of proving the driver's license validity lies with the owner.

Furthermore, the bench acknowledged the insurance company's clinching evidence of proving the driver's license to be fake/invalid and concluded that the owners' failure to discharge their initial onus absolves the insurance company of its liability to indemnify the insured.

Clarifying that the power of review cannot be used to challenge the correctness of a judgment on legal or factual grounds the bench remarked,

“Doctrine of review that same cannot be treated as an appeal in disguise nor can the power of review be exercised as an inherent power inasmuch as an order or decision or judgment under review cannot be corrected merely because it is erroneous in law or a different view could have been taken by the court on a point of fact or law”.

It thus dismissed the petition.

Case Title: Abdul Hamid Khandey Vs United India Insurance Company Limited and others

Citation: 2024 LiveLaw (JKL) 101

Mr. Syed Muhatism, Advocate appeared for petitioner